Economic benefits

The benefits of a wind farm in the area are of 4 orders:

- Annual tax proceeds due to the presence and operation of the wind farm:

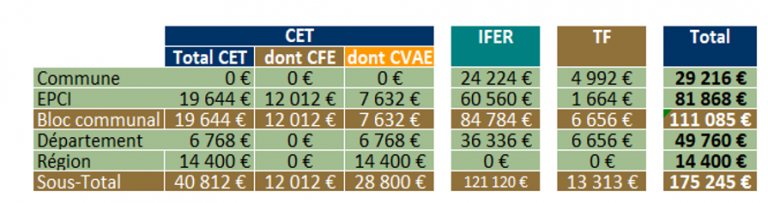

- CFE (corporate property tax), comprising the CVAE (Company Value Added Contribution) and the CET (territorial economic contribution)

- Flat-rate tax on network businesses (IFER)

- French property tax on built properties (TFPB)

- Agreement and rents relating to the siting of the wind farm

- Offsetting measures relating to modifications to the area caused by the wind farm

- Local economic activity created (local companies used for the works and technicians for maintenance of the wind turbines)

Concerning the annual tax proceeds, on the basis of the 2021 rates, the following amounts and their breakdown can be considered for a 3.6 MW wind turbine, as currently expected for the Plourac’h site.